Commuter Benefits

How the morning rush becomes smooth sailing.

Flexible, compliant, handy, savvy. What more could you want in a commuter benefits plan?

Edenred’s pre-tax commuter benefits offer hassle-free solutions that make commuting more affordable and eco-friendly. Our plans maximize tax savings for both employers and employees while simplifying HR administration. Designed to meet national regulations and backed by robust data security, we’ve been helping teams tackle commuting challenges for over 40 years.

Why offer commuter benefits?

Commuter benefits help employees pay for their daily commute with pre-tax earnings, while helping employers save on payroll taxes. Currently, nine U.S. metros mandate transit benefits, but employers across the country choose Edenred’s commuter benefits to:

- Enhance employer branding for retention and recruitment

- Support sustainable commuting initiatives

- Encourage in-office and hybrid work schedules

- Reduce employee commuting costs with optional employer contributions

Download our free guide, Commuter Benefits 101.

Estimate your savings:

how much could your company save?

Input the number of participating employees to see the potential payroll tax savings.

Number of employees

Potential annual cost savings

What's covered?

Public Transit

Vanpools

Parking

Micromobility

Discover what makes Edenred’s commuter benefits plan superior

On-the-go app

Tap & go debit card

Customer service for participants through chat or phone

Migrate from current benefits plan with ZERO downtime

World-class tech and support teams for HR, IT, employer

Micromobility for more commuting options

Pre-tax and other savings for employees and employers

Employees save taxes on up to $600 monthly…

Section 132(f) of the IRS tax code allows employees anywhere in the U.S. to set aside up to $340 per month pre-tax to pay for their public-transit commutes. Another $340 is available for eligible paid parking.

And save even more with exclusive partner discounts

From SpotHero to Lyft and Lime, Edenred’s network of partners help employees save on other expenses, too.

Employers save on payroll taxes

Employers can save an average of $40 per month on payroll taxes for each participating employee. Plus Edenred’s innovative, intuitive, and flexible commuting options can boost employee participation company-wide, which helps savings climb even more.

How one commuter plan works across your organization

Employees

Single login accesses all benefits in the on-the-go app or web portal. Check balance, reload commuter cards, upload out-of-pocket receipts anytime, and tap into Edenred-exclusive partner discounts.

HR / Benefits team

AI-automation eliminates manual expense approvals, and ensures compliance and facilitates savings on payroll taxes.

Employer brand

Micromobility add-on and exclusive discounts increase participation and engagement and help retention and recruiting. Pre-tax payroll deductions allow employers to save on payroll taxes.

Green initiatives

Switching from car to public transit eliminates a yearly average of 4,800 lbs of CO2 per person. Net-zero emissions programs support sustainability initiatives and increase adoption company-wide.

Legal

Meets local mandates and ordinances, section 132(f) of the IRS code, global data security requirements (including GDPR), SOC 2 Type II certified, and PCI compliant.

Make sustainable commuting part of your employer brand with micromobility

Edenred’s Micromobility add-on lets you offer more commuting choices and additional green-commuting options, which can give your brand a lasting environmental impact.

For commuters who travel just 20 miles daily for work, switching from single-car occupancy to public transit results in a reduction of 4,800 pounds of CO2 emissions per year.

Our Micromobility add-on includes

FAQs about Edenred’s Commuter Benefits plans

If I provide an employer subsidy for commuting, will unused funds be returned to the company when an employee leaves?

How and where does the Edenred Prepaid Card work?

Can pre-tax parking and transit benefits be used for non-work commuting?

Is a commuter benefit worth it if I’m not mandated to provide it to my employees?

- Save on payroll taxes (employers may save up to $40 a month for each participating employee)

- Support green and sustainable commuting initiatives

- Differentiate the employer brand in markets where commuter benefits aren’t mandated

- Differentiate employer brands with the Micromobility add-on in markets where commuter benefit mandates exist

- Encourage return-to-office or transitions to hybrid scheduling for employees

What’s the difference between transit benefits and commuter benefits?

Is Edenred’s Micromobility add-on paid with pre-tax dollars?

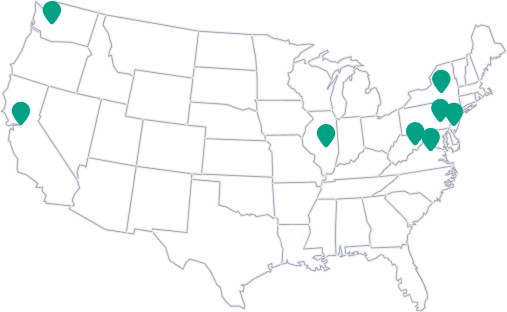

Commuter benefits that meet local mandates and ordinances

U.S. employers in the following metros are required to offer commuter benefits to their teams.

Download our free All-in-1 Commuter Benefits Ordinance Guide